In recent years, the world has witnessed a significant shift towards digital payments, and Vietnam is no exception. Zalo Pay, a leading digital wallet service in Vietnam, has emerged as a game-changer in the country's payment landscape. In this blog post, we will explore the features, benefits, and impact of Zalo Pay on the Vietnamese economy.

1. What is Zalo Pay?

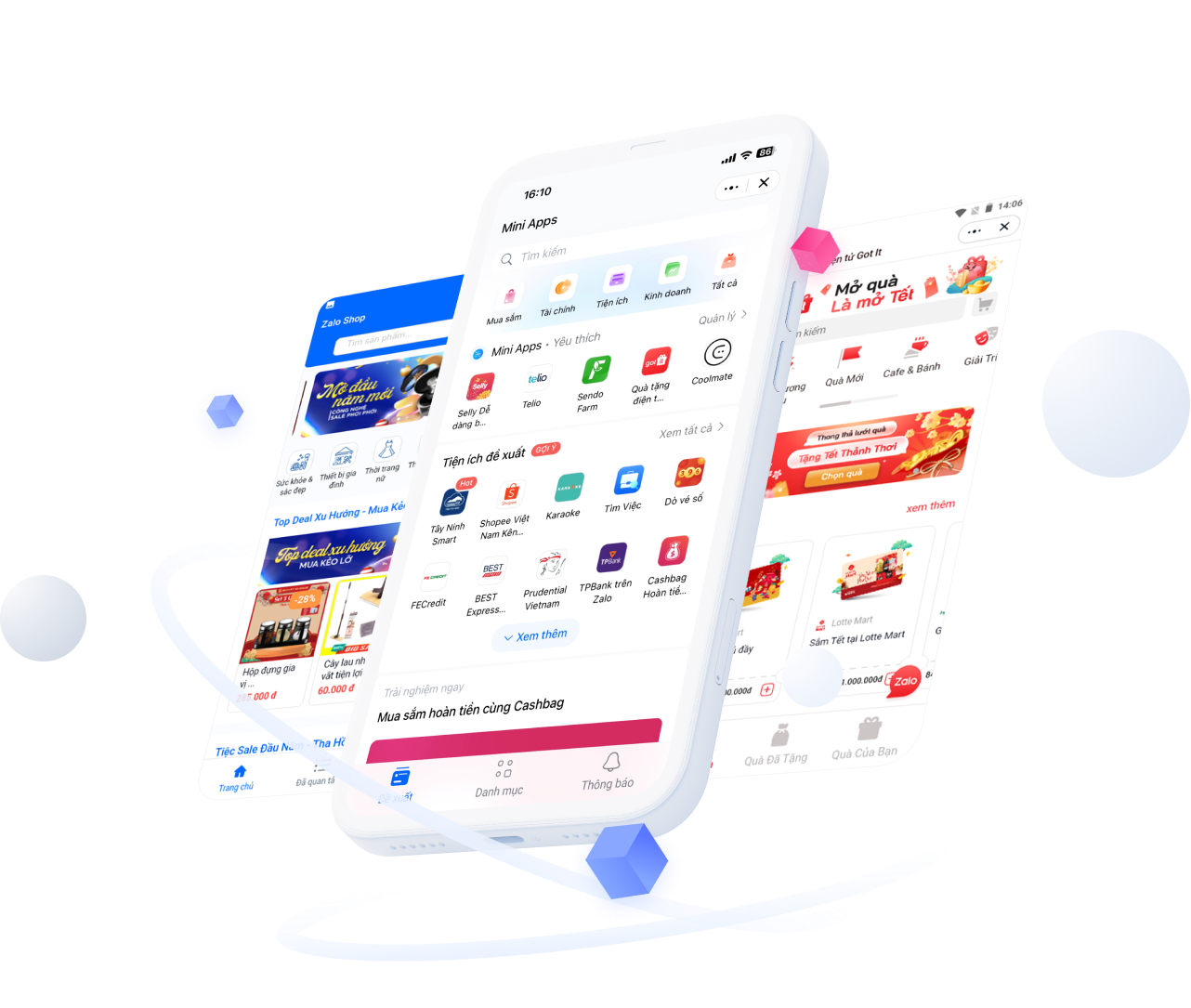

Zalo Pay is a mobile wallet solution developed by Zalo, a popular messaging app in Vietnam with over 100 million users. It allows users to make secure and convenient payments for a wide range of services, including bills, online shopping, transportation, and peer-to-peer transactions.

2. How Does Zalo Pay Work?

Zalo Pay leverages the power of mobile technology to simplify the payment process. Users can link their bank accounts or credit cards to their Zalo Pay account, eliminating the need to carry physical cash or cards. They can then make payments by scanning QR codes or entering the recipient's Zalo Pay ID./images/pic1.jpg)

3. Features of Zalo Pay

a. Bill Payments

One of the key features of Zalo Pay is its ability to facilitate bill payments. Users can settle their utility bills, such as electricity, water, and internet, directly from the app. This feature saves time and effort for users, allowing them to manage their finances on the go.

b. Online Shopping

Zalo Pay also functions as a digital wallet for online shopping. Users can make purchases from various e-commerce platforms and enjoy secure transactions without sharing their sensitive financial information. With Zalo Pay's integration with popular shopping platforms, users can enjoy exclusive discounts and promotions.

c. Transportation Services

Zalo Pay has partnered with several ride-hailing services in Vietnam, allowing users to pay for their rides directly from the app. This integration offers a seamless experience for users, eliminating the hassle of cash transactions and providing an additional layer of security.

d. Peer-to-Peer Transactions

With Zalo Pay, users can easily transfer money to their friends and family members. Whether it's splitting a dinner bill or sending money for a birthday gift, the app provides a quick and convenient way to transfer funds within the Zalo Pay network.

e. Cashback Rewards

Zalo Pay rewards its users through a cashback program. Users earn cashback on every transaction they make using Zalo Pay, which can be accumulated and used for future purchases or bill payments. This incentivizes users to adopt digital payments and promotes customer loyalty.

4. Benefits of Zalo Pay

a. Convenience

Zalo Pay offers unparalleled convenience to its users. With just a few taps on their smartphones, users can complete transactions within seconds. The app's user-friendly interface and intuitive design make it accessible even to those with limited technological expertise.

b. Security

Security is a top priority for Zalo Pay. The app implements robust security measures to protect users' financial information and prevent unauthorized access. By eliminating the need to carry physical cash or cards, Zalo Pay also reduces the risk of theft or loss.

c. Financial Inclusion

Zalo Pay plays a crucial role in promoting financial inclusion in Vietnam. With its widespread popularity and ease of use, the app empowers individuals who may not have access to traditional banking services to participate in the digital economy.

d. Cost Savings

Using Zalo Pay can lead to significant cost savings for both consumers and businesses. Consumers can save on transaction fees typically associated with traditional payment methods, while businesses can streamline their operations by accepting digital payments.

e. Ecosystem Integration

Zalo Pay seamlessly integrates with various service providers, including e-commerce platforms and transportation services. This integration creates an ecosystem where users can access multiple services within a single app, enhancing their overall experience.

5. Impact on the Vietnamese Economy

Zalo Pay's rise in popularity has had a profound impact on the Vietnamese economy. The widespread adoption of digital payments has contributed to the growth of e-commerce and online businesses in the country. It has also accelerated the shift towards a cashless society, reducing the reliance on physical currency.

Furthermore, Zalo Pay has played a significant role in driving financial inclusion by providing access to digital payment services for individuals who are unbanked or underbanked. This has opened up new opportunities for economic participation and empowerment.

The increased usage of Zalo Pay has also led to improved transparency in financial transactions, reducing the likelihood of corruption and tax evasion. As more transactions are conducted digitally, it becomes easier for authorities to monitor and regulate financial activities.

In conclusion, Zalo Pay has revolutionized the way people make payments in Vietnam. Its user-friendly interface, secure transactions, and wide range of features have made it a preferred choice among Vietnamese consumers. With its positive impact on financial inclusion and the overall economy, Zalo Pay is shaping the future of digital payments in Vietnam.

0 Nhận xét